Exploring the Alternative Edge: Unlocking Unique Investment Opportunities

From the Melody of Music & Film to the Elegance of Handbags: Redefine Your Portfolio with Insightful Strategies in Managed Funds & Private Equity

Alt Investing Newsletter

In this edition of our newsletter, we delve into the dynamic world of alternative investment asset classes. From the rhythmic allure of Music & Film to the timeless elegance of Handbags, and the sophisticated strategies behind Managed Funds & Private Equity, we bring you essential insights that could redefine your investment portfolio. Discover how these unique opportunities can enhance your financial strategy and keep you ahead of the curve!

🎵 The Rhythm of Returns: Investing in Music & Film

The Music & Film industries are more than just entertainment—they're thriving investment sectors with potential for significant returns. From royalties and licensing deals to the growing demand for streaming content, this asset class offers a blend of creativity and profitability. Discover how investing in music catalogs or film production can generate steady income and even outperform traditional markets.

Key Insights:

Steady Income Streams: Explore how royalties from music and film can provide consistent cash flow.

Cultural Impact: Understand the growing influence of streaming platforms and their impact on investment opportunities.

Risk Management: Learn how to navigate the unique risks associated with creative industries.

For more details: Linkedin

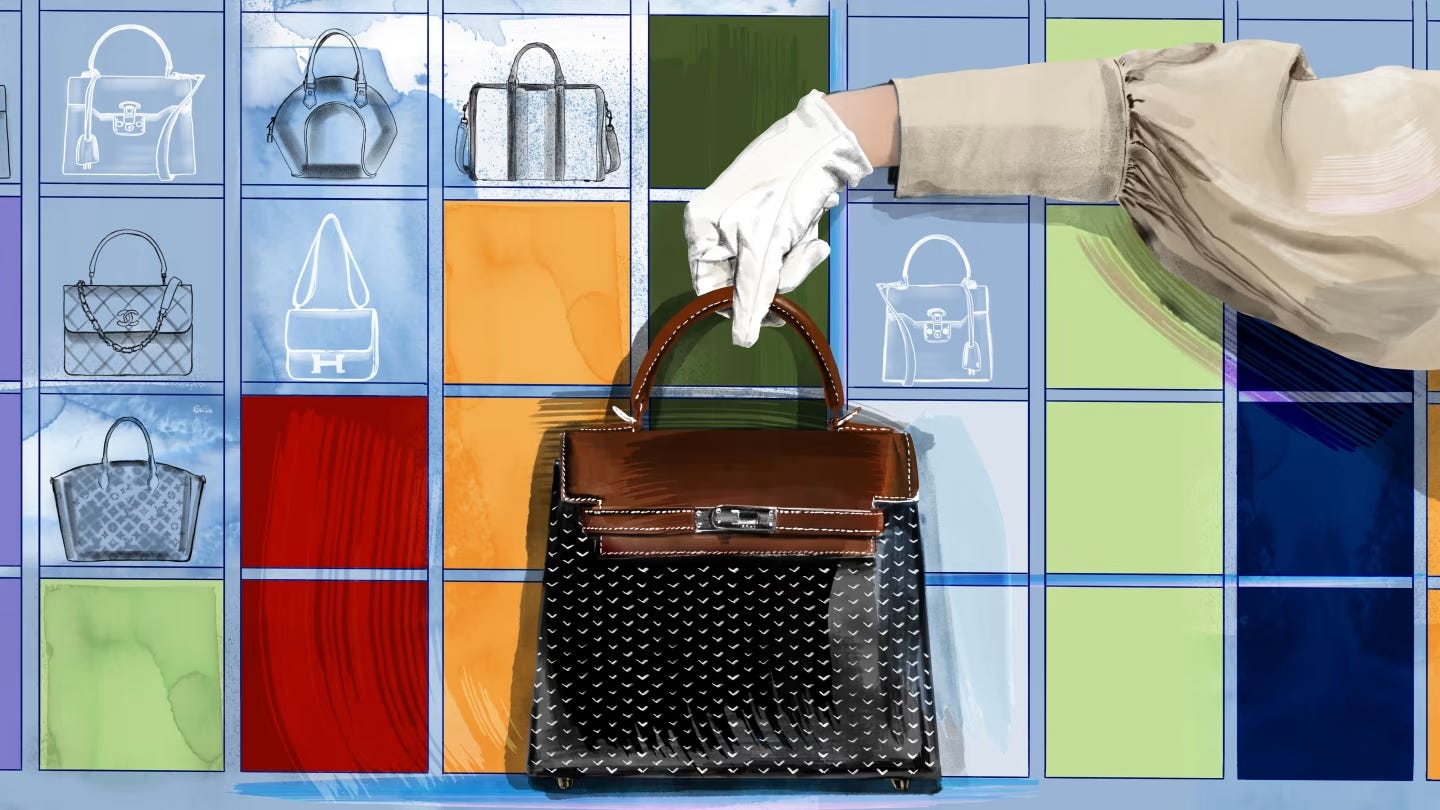

👜 Timeless Elegance: Handbags as an Investment

Luxury handbags have long been symbols of status and style, but they’ve also proven to be sound investments. With brands like Hermès, Chanel, and Louis Vuitton seeing significant appreciation in value, handbags are now considered tangible assets with impressive returns. We’ll guide you through the trends, valuation metrics, and how to identify the next “it” bag that could elevate your portfolio.

Key Insights:

Appreciation Potential: Understand why certain brands and models appreciate over time.

Market Trends: Stay informed about the latest trends driving the luxury handbag market.

Authentication and Condition: Learn the importance of verifying authenticity and maintaining condition to maximize resale value.

For more details: My Art Broker

📈 Sophisticated Strategies: Managed Funds & Private Equity

Managed Funds and Private Equity represent the backbone of many high-net-worth portfolios, offering access to diversified and expertly managed investments. These vehicles can provide exposure to a wide range of assets, from traditional equities and bonds to more specialized investments like infrastructure or real estate. In this section, we’ll explore how these funds operate, the benefits of professional management, and the long-term growth potential they offer.

Key Insights:

Diversification: Discover how Managed Funds can reduce risk through diversification across multiple asset classes.

Expert Management: Benefit from the insights of seasoned fund managers who navigate complex markets.

Growth Opportunities: Understand the potential for high returns in Private Equity, especially in emerging sectors and markets.

For more details: Preqin

Why Alternative Investments?

Alternative investments like these not only offer diversification but also access to unique markets that often remain untapped by traditional investors. Whether you’re looking to add a creative flair to your portfolio, secure tangible assets, or leverage sophisticated financial strategies, these alternative asset classes can help you achieve your investment goals.

Stay Ahead of the Curve

We hope this newsletter has provided you with valuable insights into the world of alternative investments. As always, we’re here to help you navigate these opportunities and make informed decisions that align with your financial objectives.